As you or your senior grow older, it’s important to have a variety of legal documents at hand in case of an emergency. Whether it pertains to your estate, finances, or even your own health and well-being, a few documents can play a vital role as you or your loved one ages. It can often be overwhelming when trying to get these important legal documents together, but just remember that it will all be worth it in the long run. Below we’ve listed 5 essential legal documents for seniors that should be written up ASAP.

5 Important Legal Documents For Seniors

1. Living Will

Probably the most important legal document to have as you age is a living will. Designed to help seniors keep their health, estate, and finances in order, a living will outlines the essentials that are spelled out in case you or your loved one becomes incapacitated or deceased. This is a very important document to have in case something happens to you or your loved one. If a living will is not available, then it can put your loved one’s finances, estate, and even life in jeopardy.

A properly written will helps to avoid disagreements over your parents’ estate after their deaths. Good estate planning is simply making sure that the financial assets that are most important to you and your family – no matter how much or how little — go to the intended recipients as quickly, cheaply, and easily as possible. This can help limit the number of familial disputes and will a proper recording of your or your loved one’s wishes.

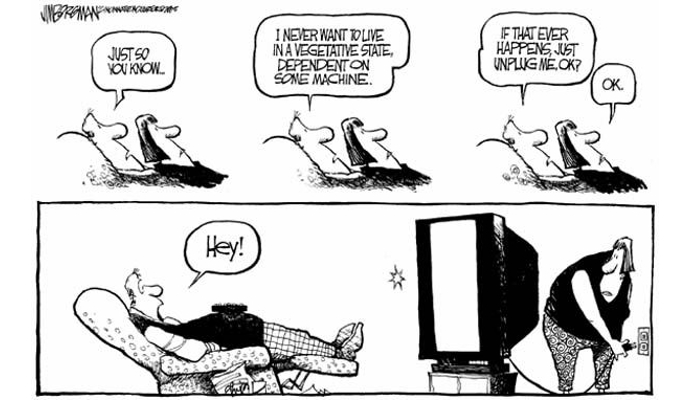

2. Advanced Healthcare Directive

This legal document will ensure that you or your loved one has the last word when it comes to end-of-life procedures. Similar to a living will, this will detail the exact procedure and steps to take if you or your senior becomes incapacitated. Directives like a DNR (Do Not Resuscitate) or an authorization of power of attorney are just a few things that could be included in your health care directive. Having an advanced healthcare directive can take the burden off of your loved ones that might have to make tough decisions regarding your health care as you age. Make sure to keep this health care directive stored in a safe place with the rest of your important legal documents.

3. Durable Power of Attorney and HIPAA Release Forms

These important legal documents actually go hand in hand, so make sure you have both in a safe place in case something happens to you or your senior. A Power of Attorney is essentially the permission for someone to make all or some of the legal decisions in case their loved one becomes incapacitated. This is where a HIPAA release form comes in. In order for the Power of Attorney to be granted access to your medical records, they must first be included on a HIPAA release form. This release for is important in case you or your senior needs immediate medical care. The form will allow the Power of Attorney to make the necessary decisions to ensure that you’re in good hands.

4. Summary of Assets and Benefits

A summary of your benefits and assets is also important to have in case of a tragic accident. This will help your Power of Attorney or whoever is in charge of your assets to correctly distribute your assets as you intended. These assets include property, pension, benefits, and any other financial asset you or your loved one might have. Make sure this is kept with your other important legal documents so it can be accessed easily in case of an emergency.

5. Revocable Living Trust

This document allows your parents to retain control over their estate while making transfers of assets to beneficiaries. Your parents designate what property (home, investments, jewelry, and so on) goes into the trust and to whom it will be granted. A revocable living trust has an important advantage: it allows your loved one’s estate to avoid probate at the time of his or her death. This is important because it will allow you or your loved one the ability to manage his or her estate in case something happens.